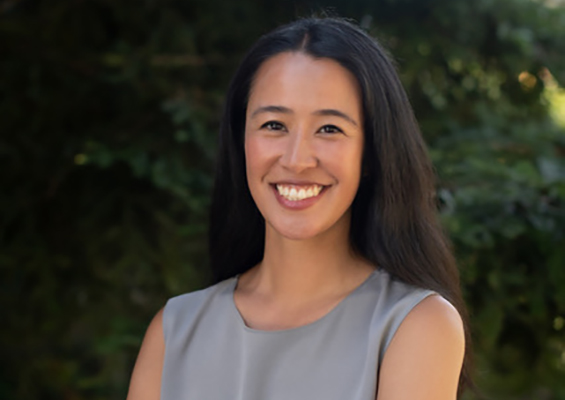

“Demonstrating that I could pivot to the funding side of investing without having a traditional quant background, while leveraging my operations background, was one of my hypotheses going into business school,” explained Jessie Tang, MBA 20. And not just any kind of investing, Jessie wanted to go into impact investing, where her work would have a positive impact on the world.

Her pivot succeeded. Jessie is now a principal and head of Strategic Initiatives at Gratitude Railroad, an impact investing platform & network headquartered in Utah. Its community of investors believes in capitalism, and in capitalism’s ability to solve environmental and social problems through the profitable deployment of financial, intellectual, and human capital.

Getting this position is proof of the importance of building relationships and of doing lots of hands-on projects while you’re still a student.”

“My role stretches from developing strategies to ensure we involve a diverse network of investors, to identifying impact infrastructure gaps in the market that we could fill,” she said. She also does due diligence on prospective investments, monitors deal flow, and works closely with the companies Gratitude Railroad has invested in. It is a role that didn’t exist until Jessie was hired.

Testing hypotheses with real-world experiences

Jessie first encountered Gratitude Railroad as an extern in her first year of the Berkeley Haas full-time MBA program as part of the Impact Investing Practicum, which comprises the New Venture Finance class, followed by an externship with an impact investing firm. She followed the externship with a summer internship at REDF, a venture philanthropy. “I was curious about the venture philanthropy model and eager to see if the consultancy approach was right for me,” she recalled. “The work was rewarding, but I realized it was not my path.”

Following her externship, Jessie stayed in touch with her Gratitude Railroad colleagues, as she planned a post-graduation move to Los Angeles. “We stayed connected and I asked who I should talk with in Southern California about impact investing. During my last semester, my now manager reached out because one of the firm’s investment associates was leaving and they were expanding the team. Following that call, we started to scope out a potential role for me,” she said. “Getting this position is proof of the importance of building relationships and of doing lots of hands-on projects while you’re still a student.”

Bolstering skills with extra-curricular activities

Other examples of project work that bolstered Jessie’s skills, confidence, and résumé include her participation in the Venture Capital Investment Competition and the Investing in Inclusion Pitch Competition, sponsored by EGAL (Center for Equity & Gender in Leadership), now in its third year. “The Investing in Inclusion Pitch Competition provided me with the chance to select and work with mission-driven startups from MBA programs across the nation. The opportunity to see them pitch, with a few ultimately receiving first funding, was incredibly rewarding.”

Jessie also served as an EGAL student fellow and on its student advisory board. She also honed her impact investing skills as a founding principal of Berkeley Impact Venture Partners. “Working with BIVP allowed me to gain direct experience of all parts of the investment lifecycle, from sourcing, to taking first calls with entrepreneurs, to completing due diligence. I also received really valuable feedback from our advisors, who are seasoned investors and social entrepreneurs."

According to Jessie, taken together, her coursework and extra-curricular activities allowed her to test her hypotheses and build the skills and relationships that she knew she needed from her time as an MBA student. Calling herself a “natural connector,” she encourages others to “build connections everywhere you can; don’t be shy about introducing yourself and engaging with other people. That includes faculty, guest speakers, and of course, your fellow Haasies. You’ll be grateful you did.”