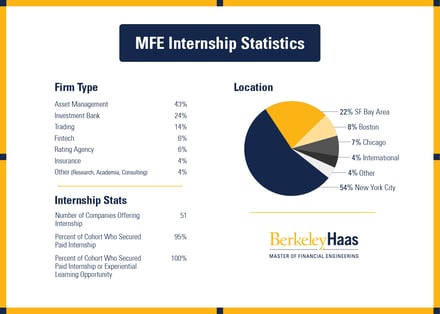

As the Berkeley Master of Financial Engineering (MFE) program begins to wind down, the class of 2024 reflects on a transformative journey of experiential learning through their internships. From October 2023 to January 2024, students immersed themselves in the dynamic world of finance, bridging theory with practice and gaining invaluable insights into their future careers.

The Berkeley MFE internship program offers students the opportunity to apply classroom knowledge to real-world challenges, collaborate with industry professionals, and explore diverse facets of quantitative finance. From quantitative research to risk management, students delve into a myriad of areas, honing their skills and expanding their horizons.

For Kishan Patel, the internship at ROW, a systematic global macro firm, provided a platform to apply econometric tools and optimization techniques learned in the classroom. He reflects, "Time series analysis, Principal Component Analysis (PCA), and convex optimization were the most used concepts during my internship... quite helpful in improving/optimizing the models I was working on."

Chunni Jiang emphasizes the application of statistical knowledge from the Empirical Methods in Finance course. "Statistical knowledge from 230E Empirical Methods in Finance helped me a lot," she notes. "When performing statistical models in my internship, knowledge from 230E provided me with solid theoretical methods to analyze all the problems and carry out tests systematically."

Antoine Franceschi's internship insights gained at Morgan Stanley shed light on the relevance of coursework in navigating complex financial markets. He remarks, "Nancy Wallace’s Asset-Backed Security course has been an invaluable help throughout my internship... It guided me and gave me clues to dive into this very complex market."

Beyond technical skills, the internship journey fosters the development of critical thinking, problem-solving, and communication abilities. Kishan emphasizes the importance of guidance in navigating quantitative research, stating, "The internship helped me learn how to construct the trajectory of a research process... we need to create a new direction very frequently."

Chunni highlights the importance of understanding project objectives, stating, "Having a big picture helps people understand the project thoroughly so it’s a lighthouse making sure we’re on track to solve this problem." Antoine demonstrates the significance of curiosity and questioning, remarking, "Asking questions is not a weakness, but a way to keep learning and growing in our job."

The internship experience not only provides students with practical skills but also offers insights into diverse career paths within quantitative finance. Kishan's exposure to systematic global macro strategies solidified his interest in such firms, while Chunni's exploration opened doors to diverse fields within the industry. Antoine's hands-on experience reaffirmed the importance of practical application in financial modeling.

As the class of 2024 returns to the classroom, their internship experiences will continue to shape their academic pursuits and professional trajectories. The Berkeley MFE internship journey fosters a culture of experiential learning, equipping students with the skills, knowledge, and insights to thrive in the dynamic landscape of finance. As we look ahead, we remain committed to nurturing the next generation of quantitative finance leaders through innovative experiential learning opportunities.