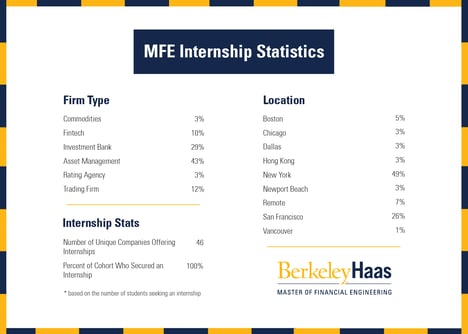

Our students embarked on their 12-week internships at the start of October. While most programs offer a summer internship, Berkeley MFE students are given the opportunity to explore potential careers options through a fall internship. This year students were placed in varying roles from Quantitative Finance Associate to Quantitative Research Intern at diverse and notable companies. For many students, the skills they learned in the classroom in the MFE Program were crucial to their success in their internships. Not only was the curriculum directly relevant to their industry work, the rigorous coursework also polished students’ existing soft and hard skills.

Siddhant Madan, who interned at BlackRock, found that the fixed income course in the program helped him quickly “pick up the jargon and terminology used in the credit team” and to “contribute to the team’s efforts right off the bat.” For Marie-Augustine Daillet, who interned at Morgan Stanley, “a lot of [her] work involved pricing derivatives related to bonds,” which was based on knowledge directly from core classes from the MFE curriculum.

The internship period, a required component of the curriculum, allows students to gain hands-on experience in their fields, build upon their skill sets, and gain a better outlook on their future career goals. The internship “helped me to work more autonomously, without having a set of questions (like in assignments) to guide me in my project,” Daillet said. “It also taught me to be creative when problem solving.” Our students agree that the value of the internship has help solidify the gap between in-class and real-world skills. Daisy Dai, who interned at PIMCO, states, “I [had] to figure out many objectives and details of the projects [myself] given the big context.”

For other students, on-the-job experience meant not just improving on hard skills, but also soft skills. “Technical proficiency is essential for success in the quantitative finance industry,” Madan said, “[but] good communication skills are just as important.”

Beyond building experience, interning gave students the chance to confirm their interest in their respective fields. Many MFE students felt that the opportunity to intern at well-established firms and being on the inside allowed them to get a more complete picture of their future career paths. Somanshu Dhingra, who interned at GTS Securities, said that he “[gained] insights into the expected work and the required skill-set across different roles like Software Engineer, Quant Researcher, Data Scientist, Trader, etc., which helped [him] decide the most suitable role for [him] in this industry.” For others, their internships and hands-on experience in their specific roles helped confirm their career interests.

From start to end, the entire internship process is a learning opportunity, and the MFE students have a number of tips for students who are starting their career paths. “Ask lots of questions, even if these questions might seem pretty simple,” Daillet said. “You are here to learn, and your internship supervisors know that.”

Moreover, an internship is also an extended opportunity to network and learn from others. “Take advantage of any training or development opportunities that are offered,” Madan said. “These have provided valuable insights into what other teams in the firm are working on and have given me ideas to try and apply in my own projects.”

The MFE Program is incredibly proud of its students and excited to welcome them back for the winter term.