Juan Rassa, MFE17, had a specific goal when coming to the MFE Program at Berkeley in March of 2016. He was going to get his MFE degree, work as a data scientist, and in his spare time, he would build a robo-advising firm with two co-founders. A year and a half later, his dream is alive and well. For the first time in Colombia, his company has launched a hybrid wealth management platform, extending beyond the traditional robo-advisor concept.

Juan Rassa, MFE17, had a specific goal when coming to the MFE Program at Berkeley in March of 2016. He was going to get his MFE degree, work as a data scientist, and in his spare time, he would build a robo-advising firm with two co-founders. A year and a half later, his dream is alive and well. For the first time in Colombia, his company has launched a hybrid wealth management platform, extending beyond the traditional robo-advisor concept.

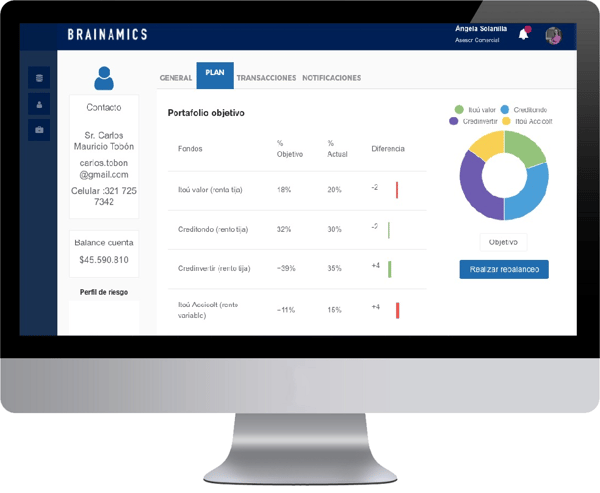

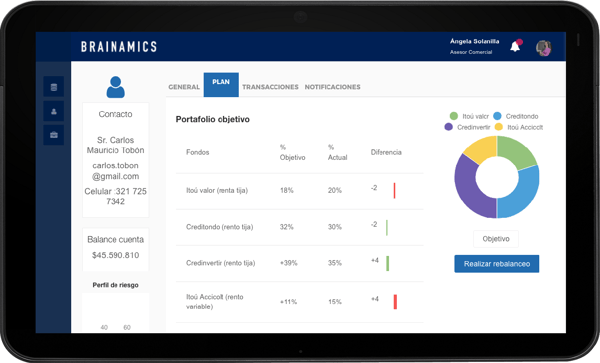

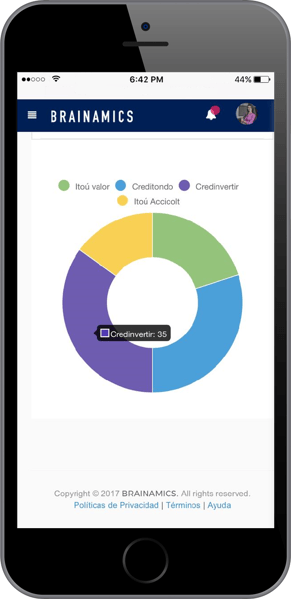

Welcome to Brainamics, a B2B company! With friends David Quinche, a former portfolio optimization director at Colombia’s largest pension fund Porvenir AFP, and Andrés Toncel, a former marketing and sales director at the biggest exporting software company Open International in Colombia, Juan is ready to start Brainamics’ operations in Colombia, with a plan to target additional countries, especially in South and Central America, that have similarities in the investment models of financial institutions in these markets. At this time, Juan and his colleagues have built a series of APIs through which the financial institutions can connect and interact with their investor profiling services, asset allocation models, and other financial monitoring algorithms, giving them the entire tool-set to offer and market their own robo-advisor service. They have also developed a hybrid platform for financial advisors that packages financial tools and algorithms, provides real-time investing feedback, and has CRM and analytics features that provide a unique interactive experience between advisors and clients, leveraging the advisor's experience with solid financial concepts and models. Juan, David, and Andrés have focused on enhancing the advisor's efficiency and productivity. Their proprietary risk profiling module closes the gap between people’s stated and perceived risk preferences, while their portfolio allocation models and advisor tools are continuously learning from client’s observed investing behaviors, timing, and propensity to buy/sell. In fact, their models can incorporate financial institutions’ own views and portfolio tilts. They are adapted to Latin America’s investment culture and advisory process.

Currently they have a fully functional demo of both the Robo-Advisor API and the Hybrid platform, and for the last two months they have been in productive meetings with Itaú and Citi. Their products offer a state-of-the-art approach to investment advisory, and during the past year, robo-advisors like Charles Schwab and several others have begun to introduce hybrid advisory products, allowing clients to receive inputs from both financial software and human advisors.

We asked Juan to provide images of the software's interface:

The Berkeley MFE Program is well-known for recommending for admission innovators like Juan Rassa, and we look forward to his continued growth post-MFE!

Learn more about the Berkeley MFE Program and how we can help you launch or advance your career by going to our website or by joining an information session.