Banking has historically been one of the few business sectors most resistant to disruption by technology. Former Federal Reserve Chairman Paul Volcker wasn’t flattering the financial industry when he said in 2009 that the only useful thing banks have invented in the last 20 years is the ATM, though he may have had a point.1 There are times in history when inventions have fundamentally changed how industries function - this may be one of those moments.

Banking has historically been one of the few business sectors most resistant to disruption by technology. Former Federal Reserve Chairman Paul Volcker wasn’t flattering the financial industry when he said in 2009 that the only useful thing banks have invented in the last 20 years is the ATM, though he may have had a point.1 There are times in history when inventions have fundamentally changed how industries function - this may be one of those moments.

Fintech broadly refers to the technologies and businesses that are emerging to rival traditional banking and financial players; it covers an array of services, such as crowdfunding platforms, mobile payments solutions, international money transfers and online portfolio management tools. Fintech is “disruptive” to many industries, especially the financial industry. One major consequence of these technological improvements is disintermediation. The financial system is essentially an intermediary and it is first in line to be disintermediated.

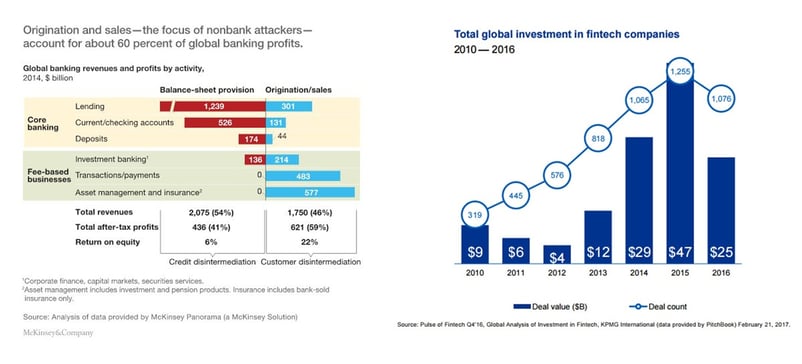

Fintech companies are rapidly growing. Per KPMG’s Pulse of Fintech Q4 2016, total global investment in fintech companies grew from $9 billion dollars in 2010 to $25 billion in 2016, peaking at $47 billion in 2015; global venture investment has grown every year, from $0.8 billion in 2010 to $13.6 billion in 2016.2 With rising global investment, fintech is capturing a greater percentage of the market and, as a disintermediary, threatening the most profitable activities of the banks, namely origination and sales. According to McKinsey’s Cutting Through the FinTech Noise: Markers of Success, Imperatives For Banks, origination and sales account for 60 percent of global banking profits and is most vulnerable to disintermediation.3

Though potentially disruptive, innovative financial technologies present a unique opportunity to the adaptive quant. Fintech has precipitated a transformation in the financial industry, which necessitates that our students become “full-stack quants”: quants that excel at coding, statistics/machine learning and who have strong economic and financial intuition. They are masters of Python and R for fast-implementation, C++ for backend-support, and SQL for database queries and familiarity. Knowledge of finance, especially pricing theory and market intuition, is equally important. Finally, machine learning, data-driven and AI-related models are increasingly in demand, both by fintech and the traditional financial institutions that these innovations are transforming. A lot has changed since Volcker commented on the industry in 2009. The financial landscape is evolving and we, at the Berkeley MFE, are evolving with it.

Follow this fintech series as I guide you through the changing landscape: we’ll examine in greater detail how exactly fintech is transforming the industry, what new skills are needed for finance and how the Berkeley MFE Program is addressing the challenge.

For the most up-to-date info, follow us on Facebook, Twitter, and LinkedIn. Learn more about the Berkeley MFE Program and how we can help you launch your career by going to our website.

Photo credit: Monito - Money Transfer Comparison via VisualHunt / CC BY